Srs Top Up Limit

Not suffering from a mental disorder. Calculating SRS tax relief.

All You Need To Know About Srs Sgmoneymatters

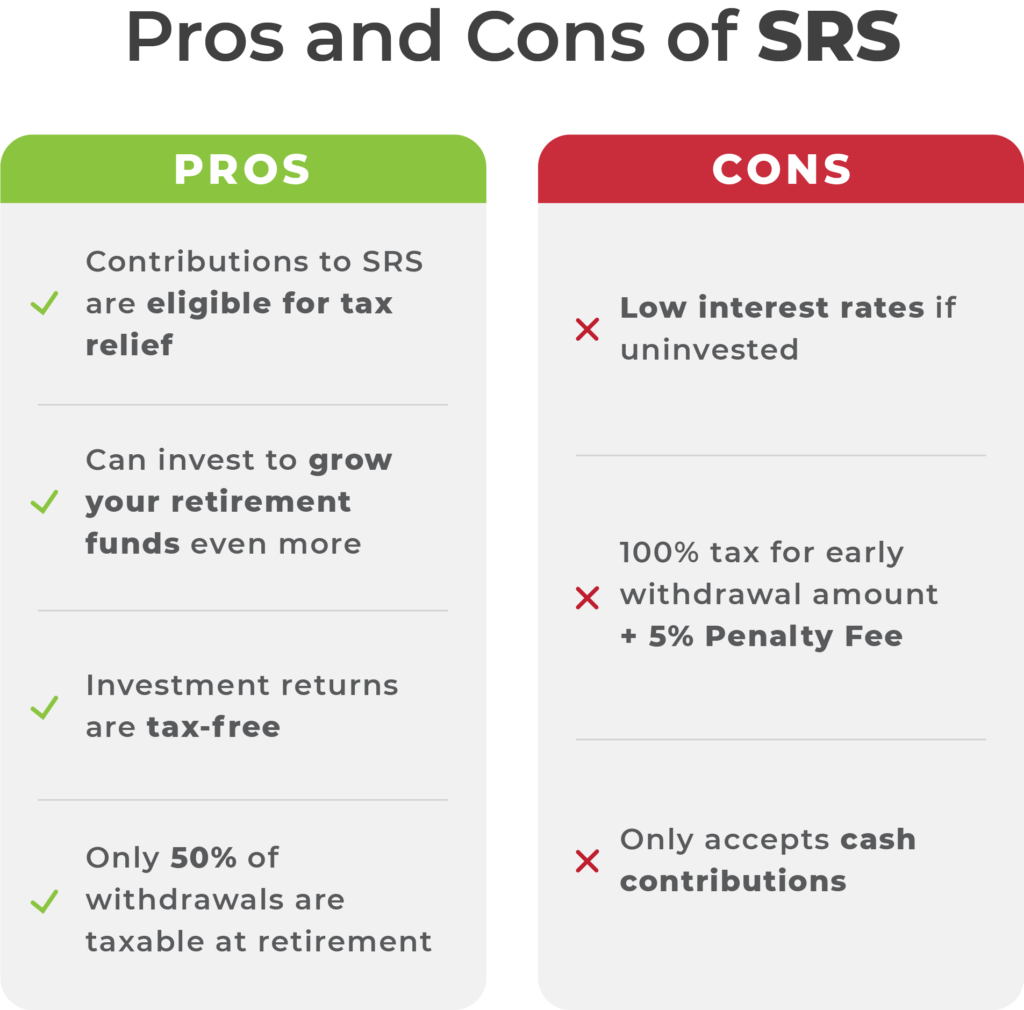

Put your SRS contributions to work.

. Top-up amount to mothers CPF Retirement Account in 2021. CPF vs SRS top ups. We can choose to make further top-ups to our Special Account up to the Full Retirement Sum FRS but will not receive any tax relief beyond the first 7000 or 8000 from 1 January 2022.

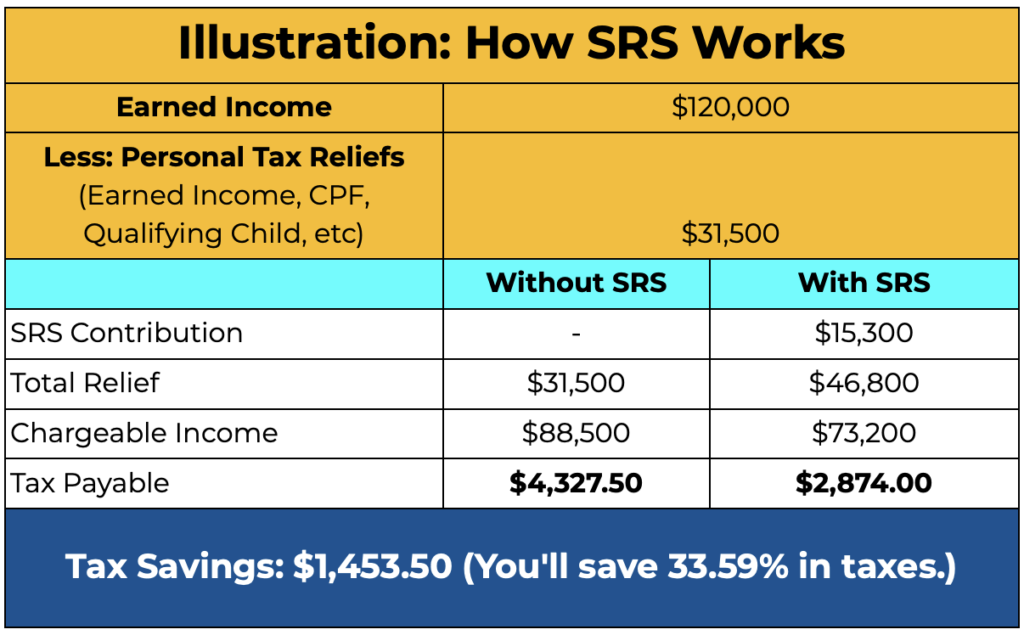

SRS Topup mobile application allows our MasterDealerUser to generate attractive income 247 365 days. If you choose to contribute 12750 to your SRS account your chargeable income will be reduced to 107250 120000 12750 and your income tax payable will become 648375. You can make an SRS contribution to top up your SRS account as many times a year as you like up to a maximum of S15300 for Singaporean citizensPRs and S35700 for foreigners.

Contribution to Supplementary Retirement Scheme SRS Account. You can enjoy an additional tax relief of up to 7000 per calendar year if you use cash to top up for your siblings spouse parents or grandparents. We covers all Malaysia prepaid reloads Bill payments Soft-pin and International Reload You can begin your business immediately.

Not suffering from a mental disorder. Lets use some numbers. If you can afford to do both top-ups you may want to do both since you can truly make full use of all tax reliefs limited to the yearly 80000 tax relief cap.

SRS account Retirement Sum Topping-Up RSTU Scheme Under the RSTU scheme the maximum tax relief you can claim from topping up your own SA in a calendar year is 7000. Tax reliefs are limited to S7000 a year in the SA and S15300 a year in the SRS. For SingaporeansPRs you can get tax relief of up to 3366 in Year of Assessment 2021 with a personal contribution cap of S15300 if.

And Capable of managing yourself and your affairs. This is a strategy widely used by many Singaporeans. Currently the maximum yearly contribution to SRS is 15300 for Singaporean and PR 35700 for foreigners To enjoy the tax savings you need to open an SRS account with one of the local banks ie.

We can choose to make further top-ups to our Special Account up to the Full Retirement Sum FRS but will not receive any tax relief beyond the first 7000 or 8000 from 1 January 2022. The SRS gives us a dollar-for-dollar tax deduction on top-ups of up to 15300 and 35700 for foreigners a year. Both these figures will rise to 8000 from 1 January 2022.

Both these figures will rise to 8000 from 1 January 2022. Even if youre not earning 40000 a year you can open your SRS account and top-up 1 to lock-in your retirement age. - Prepaid Postpaid mobile top up for all.

At least 18 years of age. SRS is for individuals diagnosed with severe and persistent mental illness SPMI andor certain diagnosed chronic conditions DCC or who are active on the solid organ or soft tissue transplant waiting list. You have income below 2349 per month 28188 per year You are 21 years of age or older.

1 assuming if your pay is 170000 and relief is 56000. Please ensure that your SRS contribution does not exceed your balance contribution limit. With two separate schemes which one can enjoy tax savings from you might ask which one is preferable.

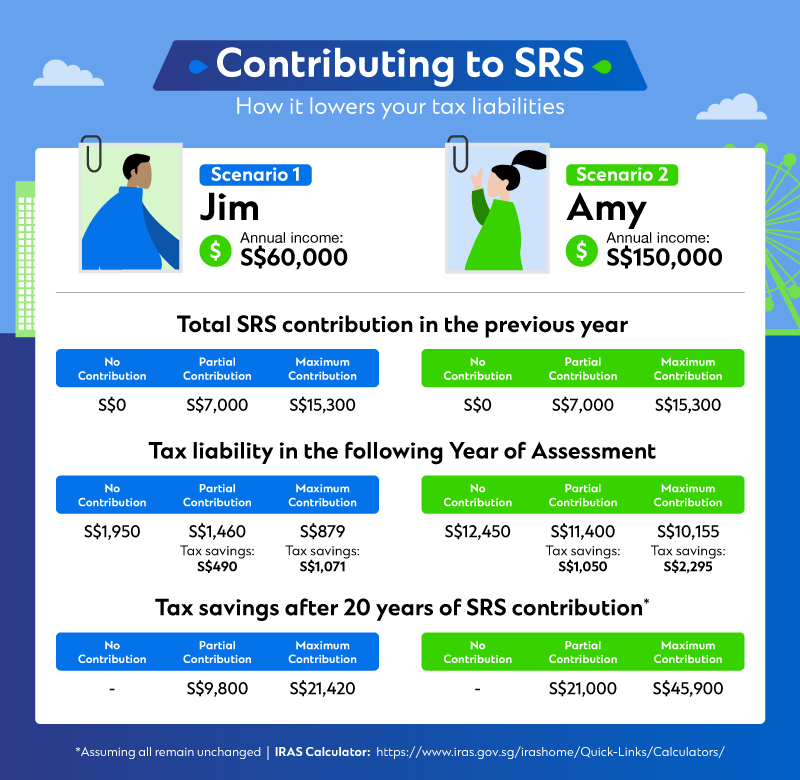

SRS helps you save on tax. Here are how the numbers look like. - Fast and smartest way to do online recharges digital payments.

If youre earning more than 40000 a year you should seriously consider using the SRS to enjoy tax relief and pay lesser income tax. Contributing cash to the CPF SA or to the SRS. Both after all are very long term investment and savings vehicles.

These are the requirements. You can enjoy tax relief of up to 7000 per calendar year if you use cash to top up for yourself andor receive cash top-ups from your employer. Furthermore you can claim up to another 7000 in tax relief if you top up the SA or RA of your loved ones.

2 Assume you contribute 15300 to SRS your tax will be 5500. At least 18 years of age. If youve heard of the idea to top up S1 to your SRS account heres the reason why.

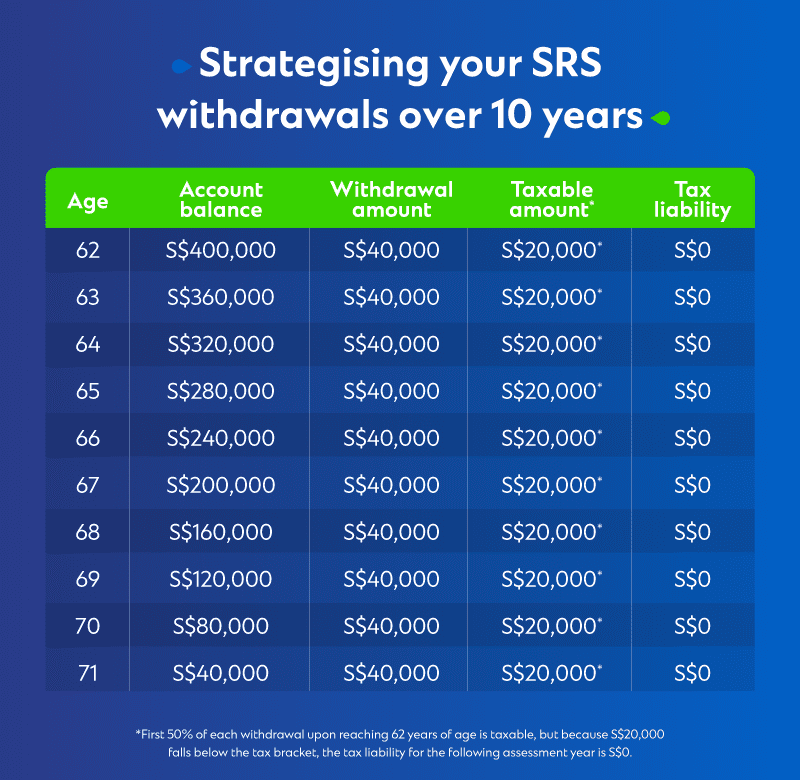

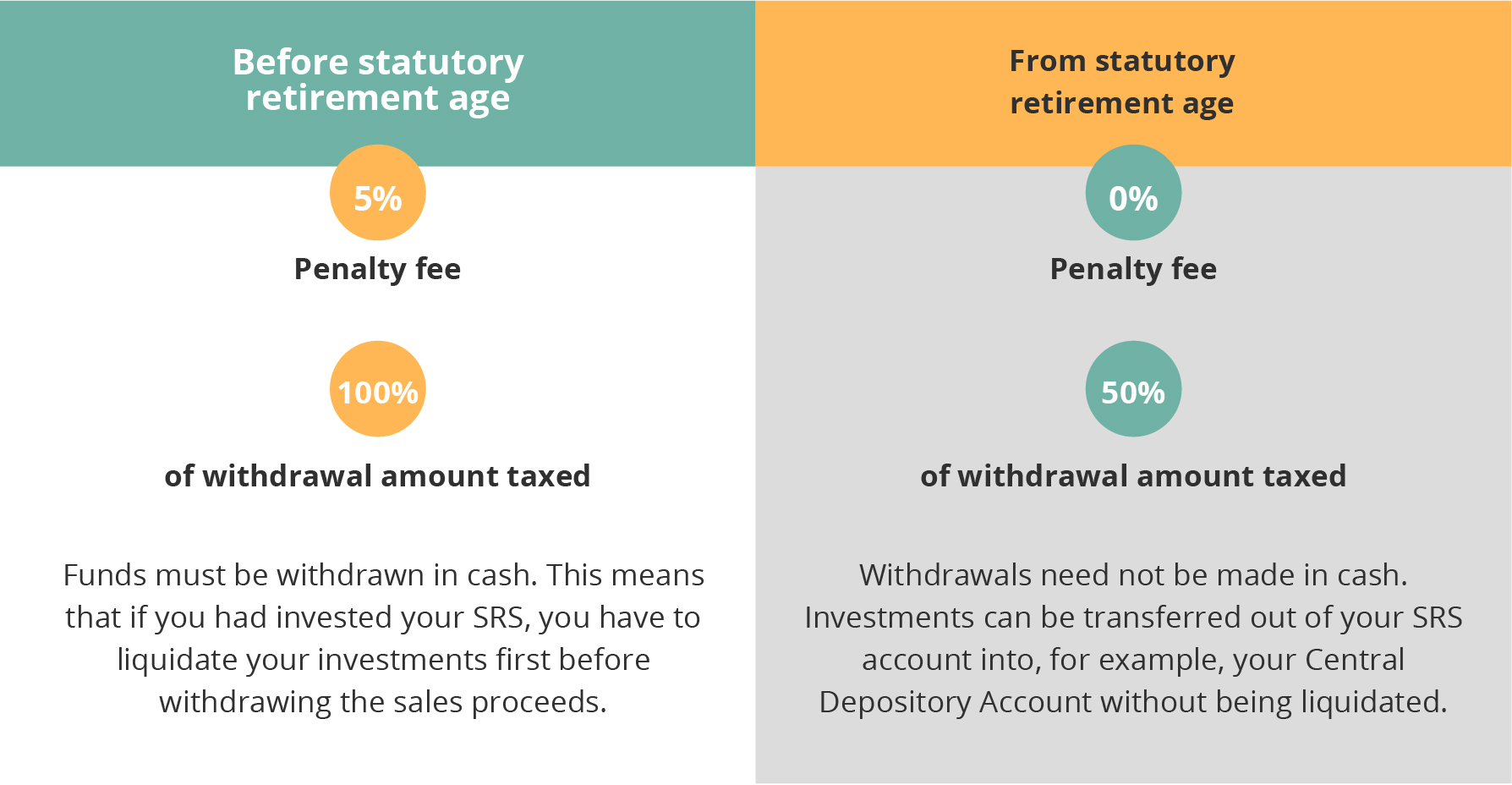

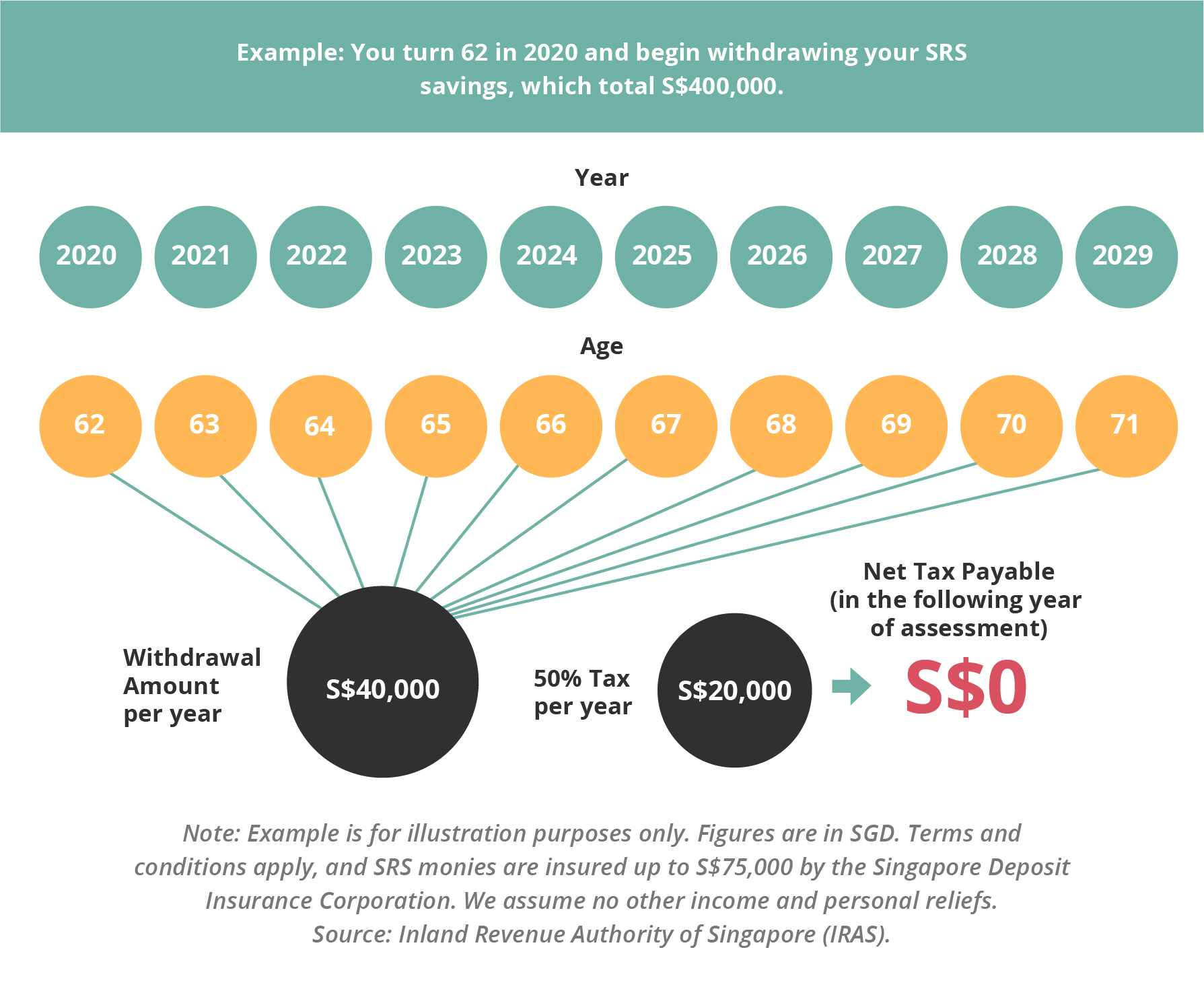

You can choose to open your SRS account with any of the following banks in the private sector. It was announced last year that the retirement age will be raised from 62 to 63 in 2022 and further increased to 65 by 2030. We can consider topping up our SRS over CPF top-up to try to grow our wealth at more than the CPF SAMA rates of 4 by investing in a portfolio that holds more equities.

Without SRS your tax is 7260. Not an undischarged bankrupt. The maximum CPF Cash Top-up Relief per Year of Assessment is capped at 7000 in total for family members.

Guides Your Guide to digibank. You can reduce your taxable income by the same amount contributed to your SRS Account with a maximum yearly contribution of S15300 for Singaporeans and Singapore PRs and S35700 for foreigners. The SRS gives us a dollar-for-dollar tax deduction on top-ups of up to 15300 and 35700 for foreigners a year.

SRS contribution cannot be done via other banks internet banking. For Year of Assessment 2022 Mr Tan may claim a total CPF Cash Top-up Relief of 7000. Think of the SRS as an extra savings and investment account for retirement planning.

Cheques received before 330pm on a working day the funds will be credited to SRS account around 400pm on the following working day if the cheque is good for payment. Build your dream retirement. Total CPF Cash Top-up Relief.

For customers to be eligible for tax relief in 2023 contributions must be made before 7pm via digibank on 31st December 2022. Not an undischarged bankrupt. If you have been investing consistently and are comfortable with the volatility of the stock market we strongly recommend topping up your SRS account as well.

Contributions must be made by 30 December of each year in order to be eligible for tax. To be eligible for SRS the following criteria must also be met. It is a purely voluntary scheme unlike our CPF where you can contribute any amount subject to a cap of 15300 yearly.

DBS OCBC or UOB. SRS top-up method that gives you income tax relief. Which means you save up to 1759 which is about 24.

Simply by contributing 12750 to your SRS account you will be able to reduce your income tax by 146625. DBS UOB and OCBC. The SRS account can help you grow your retirement savings so it is worth considering if youve reached the contribution limit on your CPF account.

You can read my article All you need to know about SRS for more details about the scheme. Topping up your Supplementary Retirement Scheme SRS account to lower taxable income.

Guide To Supplementary Retirement Scheme Srs Account Promotions 2022

Make The Most Of Your Srs Account With These Strategies Standard Chartered Singapore

Srs Withdrawals Stagger And Save Dbs Singapore

How To Save On Taxes Using The Srs Moneyowl

Supplementary Retirement Scheme Srs Guide For 2022

Pros And Cons Of Contributing To Srs Is It Worth It Insurediy Blog

Make The Most Of Your Srs Account With These Strategies Standard Chartered Singapore

Srs Withdrawals Stagger And Save Dbs Singapore

Camo Mercedes Benz Amg Gts Gentbelike Courtesy Of Srs Swissrichstreets Bmw Exclusive Cars Top Cars

0 Response to "Srs Top Up Limit"

Post a Comment